Finance automation is transforming how organizations manage their financial operations, yet most are barely scratching the surface. While 98% of CFOs are investing in digitization, only 25% of finance processes are actually automated (McKinsey), leaving millions on the table through inefficient manual work.

What’s driving this urgency? Finance automation in 2025-26 isn’t just reducing costs by 70% (Gartner) – it’s enabling strategic decision-making through real-time insights. More importantly, organizations implementing comprehensive automation report a 250% average ROI within two years (Forrester), alongside 90% faster processing times (PwC) and accuracy rates exceeding 99.5%.

The results speak for themselves. According to Gartner’s survey on Finance Technologies, 88% of organizations reported tangible benefits from Robotic Process Automation (RPA) – including improved efficiency, increased speed and agility, and significant boosts to employee productivity.

This comprehensive guide explores 9 finance automation use cases delivering measurable ROI, with practical implementation insights for finance leaders.

What is Finance Automation?

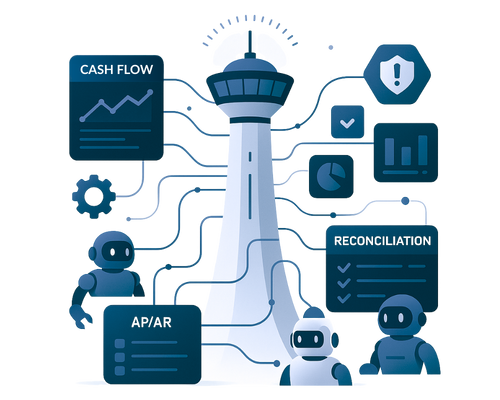

Finance automation uses AI, machine learning, and RPA technologies to streamline repetitive financial processes, reducing manual intervention by 70-90% while improving accuracy to 99.5%+.

But here’s the critical distinction: the difference between automation and traditional software lies in execution. Traditional accounting systems record and track transactions, yet they still require humans to input data, match records, and generate reports. In contrast, automation handles these tasks end-to-end – extracting invoice data from emails, matching it to purchase orders, routing for approval based on business rules, posting to the general ledger, and updating cash forecasts. All of this happens without human intervention.

Finance departments manage numerous workflows involving different departments, people, systems, and data. When executed manually, these tasks introduce error rates of 5-10% according to KPMG’s 2023 Financial Automation Survey. Beyond accuracy issues, manual processes create bottlenecks during peak periods and divert skilled professionals from analysis to data entry.

Industry Benchmarks for Finance Automation

According to recent research from leading industry analysts:

- 88% of organizations report significant benefits from RPA in finance (Gartner)

- Average ROI of 250% achieved within 24 months (Forrester)

- 70% reduction in processing costs for fully automated processes (Gartner)

- 90% faster transaction processing vs manual methods (PwC)

- 62% of CFOs view AI as critical to operations by 2026 (Gartner)

- 95% of finance leaders are actively investing in AI technologies (KPMG)

- 99.5% accuracy rates in automated processes vs 90-95% manual accuracy (Industry report)

9 Finance Processes Leaders Must Automate in 2026

1. Accounts Receivable (AR) Automation

Manual AR processes create significant cash flow friction. Finance teams spend hours generating invoices, tracking payments, following up on overdue accounts, and manually reconciling incoming payments. As a result, the average Days Sales Outstanding (DSO) for manually managed AR sits at 45-60 days, with collection costs consuming 2-3% of revenue.

Automated AR changes this fundamentally. Rather than batch-processing invoices at month-end, the system generates and delivers them immediately upon order fulfilment. Subsequently, when payments arrive, automation matches them to open invoices using sophisticated algorithms that handle partial payments, discounts, and cross-invoice applications. For overdue accounts, the system executes dunning workflows that escalate from gentle reminders to firm collection notices based on aging and customer risk profiles.

Accounts Receivable (AR) Automation

Cosmo automated its Accounts Receivable (AR) process with Intelligent Automation, standardizing operations, reducing manual effort, and ensuring faster collections and consistent visibility.

Read Case Study2. Accounts Payable (AP) Automation

Manual AP processing is expensive and error-prone. Finance teams download invoices from emails, manually enter data into ERPs, route paper copies for approval signatures, chase busy managers for sign-offs, and manually schedule payments. As a result, processing a single invoice takes 12-15 days on average and costs $12-15 in labor according to APQC benchmarks.

In contrast, automated AP processes invoices in under 48 hours at $3-4 per invoice. More importantly, it eliminates the frustrations that make AP one of the least satisfying finance roles – lost invoices, duplicate payments, missed early payment discounts, and constant vendor inquiries about payment status.

Accounts Payable (AP) Automation

Cosmo, a major flexible packaging company, automated its Accounts Payable (AP) process with Intelligent Automation, streamlining invoice handling, reducing manual effort, and strengthening vendor relationships.

Read Case Study3. Record to Report (R2R) Automation

Month-end close is the most stressful time for finance teams. Accountants work long hours closing subledgers, posting accruals and adjustments, reconciling accounts, consolidating entities, and preparing management reports. Typically, the average close takes 8-10 business days, with many teams working evenings and weekends to meet deadlines.

R2R automation compresses this timeline to 3-5 days while improving accuracy and providing earlier insights to leadership. Specifically, it eliminates the manual journal entry posting, spreadsheet consolidations, and repetitive reconciliations that consume close time.

4. Customer Onboarding Automation

Manual customer onboarding creates revenue delays. Sales teams close deals, but finance requirements – credit applications, bank references, legal reviews, system setups – can delay first invoices by weeks. Poor documentation quality leads to compliance issues and audit findings.

Automated onboarding accelerates time-to-revenue while ensuring complete, accurate records from day one. The system automatically handles document collection, verification, credit assessment, and provisioning, reducing onboarding time from weeks to days.

5. Vendor Onboarding Automation

Manual vendor onboarding is slow and exposes organizations to significant risk. Finance teams collect documents through email chains, manually verify information, and often skip thorough due diligence when business needs are urgent. Unfortunately, this creates duplicate vendor records, fraud risk, and compliance failures.

Automated vendor onboarding systematically manages the entire process from registration to approval, ensuring comprehensive due diligence while accelerating time-to-procurement. The system handles document verification, risk assessment, compliance checks, and master data creation with minimal human intervention.

6. Bank Reconciliation Automation

Manual bank reconciliation is tedious and time-consuming. Finance teams download bank statements, export transaction lists from ERPs, and spend hours matching records in spreadsheets. Consequently, the process runs days or weeks behind, providing stale cash position information when leadership needs real-time visibility.

In contrast, automated bank reconciliation runs continuously, providing up-to-the-minute cash visibility and immediately identifying exceptions requiring investigation.

Bank Reconciliation Automation

Muthoot Finance automated its bank reconciliation process using RPATech's intelligent automation, streamlining the matching of transactions across its 1,898 bank accounts across 24 banks.

Read Case Study7. GST Reconciliation Automation

Tax compliance creates enormous administrative burden, particularly in jurisdictions with frequent filings and complex reconciliation requirements. Finance teams spend days each month reconciling purchase registers to tax portal data, identifying discrepancies, chasing vendors for corrections, and preparing returns. Unfortunately, errors result in lost tax credits and compliance penalties.

Automated tax reconciliation handles the complexity systematically, ensuring accurate filings and maximum tax credit recovery. For businesses dealing with VAT, GST, or sales tax compliance, automation transforms this from a monthly crisis to a routine process.

GST Reconciliation Automation

Max Healthcare automated its GST reconciliation process using intelligent automation, transforming a month-long manual workflow into fast, bot-driven processing across all units.

Read Case Study8. Contract Management Automation

Contracts govern critical business relationships, yet most organizations manage them poorly. Paper files, scattered digital repositories, and minimal tracking of terms and obligations create significant risk. Companies miss renewal deadlines, lose negotiating leverage, fail to enforce favourable terms, and struggle to locate contracts when needed.

Poor contract management costs organizations an average of 9% of annual revenue according to World Commerce & Contracting – a staggering figure that includes missed early payment discounts, auto-renewals of unfavourable terms, unused volume commitments, and price increases that went uncontested.

9. Fixed Asset Management Automation

Fixed asset accounting seems straightforward until you manage hundreds or thousands of assets across multiple locations with varying depreciation methods, complex capitalization rules, and stringent compliance requirements. Manual tracking in spreadsheets creates errors, incomplete records, and significant audit risk.

Automated asset management handles the complete lifecycle from acquisition to disposal, ensuring accurate depreciation calculations, physical accountability, and regulatory compliance. The system manages multiple depreciation methods simultaneously for different reporting requirements while tracking maintenance schedules and optimizing asset utilization.

Other Finance Automation Related Case Studies

The Strategic Impact: How Automation Transforms Finance Teams

Beyond cost reduction and efficiency gains, automation fundamentally changes finance team capabilities and contributions to the business.

From Backward-Looking to Forward-Looking

Manual finance teams spend 70-80% of their time recording what already happened – entering transactions, reconciling accounts, preparing historical reports. Automation inverts this ratio. When systems handle routine recording and reporting, finance professionals redirect that time to analysis and planning.

Teams shift from answering “what happened last quarter?” to “what should we do next quarter?” They build sophisticated financial models, conduct scenario analyses, evaluate investment opportunities, and partner with business leaders on strategy. According to 2024 industry surveys, 87% of finance professionals report expanded scope of work after automation implementation, taking on responsibilities in data analytics, financial technology integration, and strategic business advisory.

From Reactive to Proactive Risk Management

Manual processes identify problems after they occur – discovering fraud during account reconciliation, finding compliance issues during audits, noticing vendor contract auto-renewals after they execute. Automation enables proactive risk management through continuous monitoring and early warning systems.

Anomaly detection algorithms flag unusual transactions immediately. Pattern analysis identifies trends before they become problems. Real-time dashboards surface exceptions as they occur rather than weeks later. Finance teams shift from damage control to risk prevention.

From Finance Function to Business Partner

When finance leaders have real-time visibility into business performance, accurate forecasts, and time for deep analysis, they become invaluable strategic partners. They contribute to pricing decisions with margin analysis, evaluate make-or-buy decisions with total cost modelling, assess M&A opportunities with robust due diligence, and optimize working capital with sophisticated cash forecasting.

Organizations implementing comprehensive finance automation report that CFOs spend 40% more time with other executives discussing strategy and 60% less time in financial reporting meetings explaining data quality issues and variances.

Critical Success Factors for Finance Automation

Start with Process Standardization

Automating broken or inconsistent processes simply creates automated chaos. Before automation, document current processes, identify variations across teams or locations, and standardize on best practices. Challenge whether all process steps add value or simply exist because “that’s how we’ve always done it.”

Organizations that invest time in process optimization before automation see 40% better outcomes than those rushing to automate current-state processes.

Ensure Data Quality

Automation amplifies data quality issues. If your vendor master data contains duplicates, automation will process invoices for duplicate vendors. If your GL account structures are inconsistent, automated reporting will produce garbage. If your customer data has accuracy issues, automated collections will contact the wrong people.

Data cleansing and master data management must precede automation. Establish data governance frameworks, clean historical data, and implement validation rules that prevent poor data entry going forward.

Invest in Change Management

Technology implementation is straightforward. People transformation is hard. Finance teams accustomed to manual work need help understanding how automation changes their roles. Some fear job elimination. Others resist learning new tools. Many question whether automation can handle exception scenarios they’ve managed for years.

Effective change management involves clear communication about role evolution (not elimination), comprehensive training programs, involvement of team members in automation design, celebration of early wins, and patience as people adapt. Organizations that shortchange change management see significantly lower automation adoption and benefit realization.

Maintain Human Oversight

Automation handles routine scenarios exceptionally well. Complex judgment calls still require human expertise. The goal isn’t eliminating human involvement; it’s elevating it. Automation handles the 80% of transactions that are straightforward, escalating the 20% requiring judgment to skilled professionals.

Establish clear escalation rules. Define thresholds for auto-approval. Maintain exception queues for human review. Review automation performance regularly and refine rules based on learnings. The combination of automation speed and human judgment delivers better outcomes than either alone.

Measure and Optimize Continuously

Automation isn’t implement-and-forget technology. Leading organizations establish automation centres of excellence that monitor performance metrics, identify improvement opportunities, and optimize processes continuously. They track straight-through processing rates, exception volumes, error rates, and processing times. When metrics decline, they investigate and refine.

They also stay current with automation technology advances. Capabilities that seemed impossible three years ago – natural language processing of unstructured documents, predictive analytics, autonomous decision-making – are now practical and affordable. Continuous learning and optimization separate automation leaders from laggards.

Take the Next Step

Finance automation is no longer optional for businesses aiming to compete effectively in 2025. With proven cost reductions of 70%, ROI of 250% within 24 months, and dramatic improvements in accuracy and compliance, the question isn’t whether to automate – it’s how quickly you can begin.

Whether you’re processing 500 or 50,000 invoices monthly, managing multi-entity consolidations, or simply looking to free your finance team for more strategic work, automation offers a clear path forward.

Ready to Transform Your Finance Operations?

Get started with a consulting session. Our automation experts will assess your processes, identify quick wins, and provide a customized roadmap specific to your business.