The Invoice Processing Problem Nobody Wants to Talk About

Your finance team processes invoices the same way they did five years ago. Manual data entry, verification spreadsheets, error corrections, payment delays.

The industry sold you OCR as the solution. You deployed it. Accuracy hit 80% on real documents. Your team still spends 67 hours monthly fixing extraction errors.

This isn’t automation. This is digitized manual work.

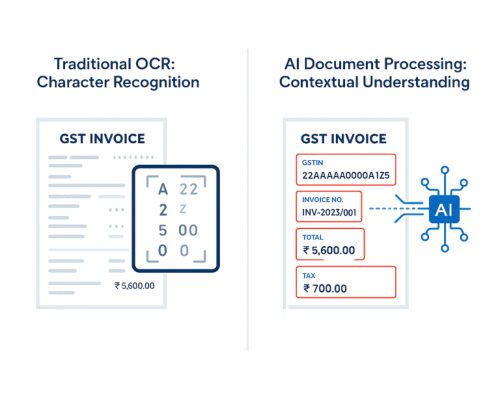

Here’s the uncomfortable truth: traditional OCR was never designed for business document complexity. It reads characters, not context. It sees text positions, not business logic. When your Indian vendor invoice has CGST, SGST, IGST, and handwritten notes, OCR breaks.

The gap between what OCR promises and what finance operations need isn’t a feature problem. It’s a fundamental architecture problem.

Why “Good Enough” Accuracy Destroys Automation Value

Most finance leaders accept 80-85% extraction accuracy as inevitable.

The logic seems sound: automate most of it, manually fix the rest.

This mindset kills automation ROI.

Every extraction error triggers a verification workflow. Your team investigates the original document, corrects the data, validates against purchase orders, and updates downstream systems. The cognitive load of error-checking is often higher than original data entry.

Consider the real cost structure:

Manual invoice processing:

- ₹50,000 monthly in direct labor costs.

- Add error correction (₹30,000)

- Compliance validation (₹20,000), and

- late payment penalties (₹15,000).

Total hidden cost: ₹115,000 monthly for a mid-sized company processing 500 invoices.

Now deploy an 85% accurate OCR system. You eliminate some manual entry but create a new problem: error correction specialists. Your finance team shifts from data entry to data validation. You’ve changed the task, not reduced the burden.

The break-even point for invoice processing automation isn’t 85% accuracy. It’s 98%+. Only at this threshold can you achieve straight-through processing where documents flow from input to ERP without human intervention.

GST compliance demands this precision.

Tax calculations must be exact. HSN codes are binary (correct or incorrect).

Invoice totals either match or they don’t.

There’s no “mostly compliant” in financial reporting.

So what does this mean for finance operations?

You need extraction intelligence that understands business document structure, not just character recognition that reads text. The difference between 85% and 98% isn’t incremental improvement. It’s the difference between workflow optimization and true automation.

The Architecture Gap: Why Traditional OCR Fails on Indian Invoices

Traditional OCR operates on a simple premise: identify text at specific positions on a page and extract those characters.

This works for standardized forms. Driver’s licenses, passports, shipping labels with consistent layouts.

Business invoices destroy this assumption.

- Vendor A puts GST numbers in the top-right corner.

- Vendor B embeds them in the footer.

- Vendor C redesigns their invoice format quarterly.

The same information appears in different positions, different formats, different contexts across thousands of vendor variations.

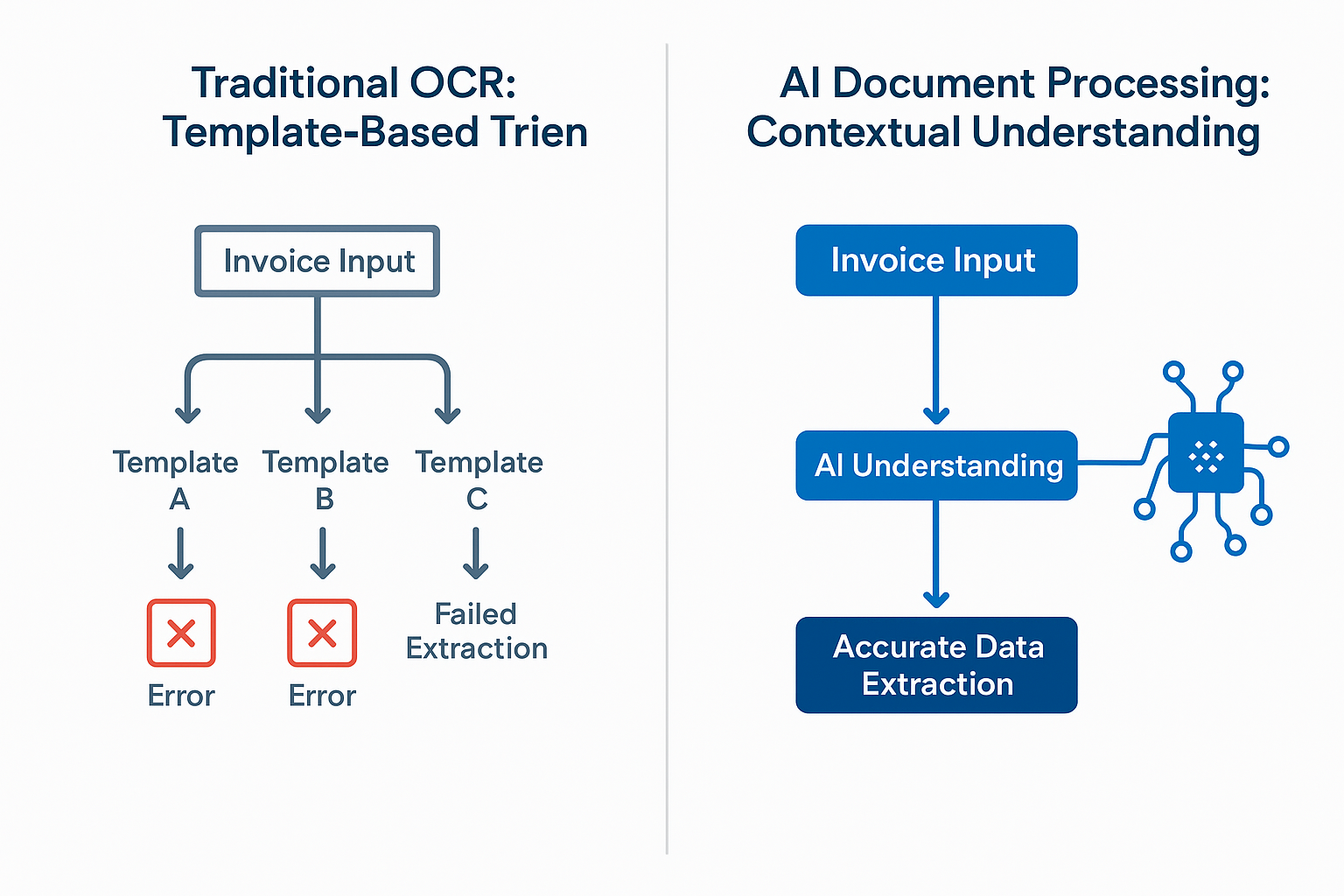

Template-based extraction tries to solve this with mapping rules. Create templates for each vendor format, map field positions, process similar documents through the same template.

The maintenance nightmare begins immediately. New vendor means new template. Format change means template rebuild. Your IT team becomes template configuration specialists instead of strategic technology enablers.

Indian business documents add layers of complexity that break positional extraction entirely:

- Mixed language processing: Invoices contain English, Hindi, and regional languages within single documents. Traditional OCR treats each language as separate extraction tasks.

- GST-specific intelligence: CGST, SGST, IGST aren’t just text strings. They’re tax components with specific calculation rules and compliance requirements. OCR sees characters. It doesn’t understand that these values must sum correctly or that HSN codes validate against government registries.

- Handwritten elements: Stamps, signatures, handwritten notes, delivery instructions. Real business documents aren’t pristine digital files. They’re scanned papers with human annotations that OCR can’t contextualize.

- Complex table structures: Invoice line items aren’t simple rows and columns. They contain merged cells, variable column counts, subtotals, discounts, and tax breakdowns. Positional extraction fails when table structures vary.

The architecture gap is fundamental. Traditional OCR was built for character recognition in controlled environments. Business document processing requires contextual understanding in chaotic conditions.

This is why we built DocXtract differently.

How AI-Powered Document Processing Changes Everything

The breakthrough isn’t better OCR. It’s eliminating OCR’s architectural limitations entirely.

Large Language Models process documents the way experienced accountants do. They understand context, recognize patterns, and validate business logic.

Here’s how the intelligence shift works:

- Contextual understanding over positional extraction: DocXtract doesn’t look for GST numbers at specific coordinates. It understands what GST numbers are, how they relate to other invoice elements, and how to validate them against compliance requirements. This means new vendor formats work immediately without template configuration.

- Multi-modal intelligence: Business documents are visual information systems. Table layouts convey relationships. Logo positions indicate sections. Signature placements validate authenticity. AI-powered document processing analyzes text, visual elements, and spatial relationships simultaneously.

- Business logic validation: DocXtract doesn’t just extract tax amounts. It validates that CGST + SGST calculations are correct, that HSN codes match item descriptions, that invoice totals reconcile with line items. This intelligence catches errors that pure extraction misses.

- Format agnostic processing: Whether your invoice is a clean PDF, scanned image, or smartphone photo, the AI understands document content regardless of input quality. This flexibility eliminates preprocessing requirements that plague traditional OCR.

The technology foundation combines GPT-4.1 for complex reasoning about tax calculations and Gemini for visual document layout understanding. This multi-model approach achieves 98%+ field accuracy on real Indian invoices, not test datasets.

RPATech’s perspective on this shift

We’ve processed over 10,000 Indian business invoices through DocXtract. The patterns are clear. Companies using traditional OCR spend more time managing extraction failures than they saved from automation. Those using AI-powered document processing achieve straight-through processing rates above 95%.

The difference isn’t incremental. It’s transformational.

From 3 Days to 3 Minutes: The Business Velocity Impact

Invoice processing speed determines cash flow velocity. Faster processing enables faster payments. Faster payments strengthen vendor relationships. Better relationships unlock better terms.

Traditional invoice processing timeline:

- Day 1: Invoice arrives via email, sits in inbox waiting for processing

- Day 2: Manual data extraction, validation against PO, error corrections

- Day 3: Approval routing, payment processing, reconciliation

Intelligent invoice processing automation timeline:

- Minute 1: Invoice uploaded to API

- Minute 2: AI extracts all fields with 98%+ accuracy

- Minute 3: Structured data flows to ERP, ready for approval workflow

This compression isn’t just about efficiency. It’s about business transformation.

- Vendor relationship advantages: Early payment discounts become accessible. You capture 2-3% savings on invoices by paying within terms. At scale, this funds the entire automation investment.

- Cash flow intelligence: Real-time invoice data enables accurate cash flow forecasting. You see upcoming payment obligations immediately instead of waiting for batch processing cycles.

- Team productivity reallocation: One DocXtract client processes 500+ monthly invoices. Previously required 67 hours of manual work. Now requires 45 minutes of API calls. The freed capacity shifts to strategic vendor management and spend analysis.

- Compliance confidence: Audit trails are automatic. Every extracted field includes confidence scores. GST validation happens in real-time. Regulatory compliance shifts from manual verification to automated assurance.

The velocity impact extends beyond individual invoices. When document processing accelerates from days to minutes, entire business rhythms change. Finance teams shift from reactive processing to proactive analysis. Procurement cycles compress. Decision-making accelerates.

Speed isn’t just an efficiency metric. It’s a competitive advantage.

The India-First Design Advantage

Global OCR solutions treat Indian business documents as localization afterthoughts. They’re built for Western formats and adapted for Indian requirements through configuration and customization.

This approach fails because Indian document processing isn’t just translation. It’s fundamentally different business logic.

- GST compliance complexity: Indian tax structure requires understanding CGST, SGST, IGST, and Cess calculations. These aren’t simple field extractions. They’re interdependent components that must validate against specific rules. Generic OCR can’t encode this business logic.

- HSN/SAC code intelligence: These codes aren’t arbitrary numbers. They map to specific goods and services with tax implications. Extraction requires validation against government registries and business context. International solutions lack this domain knowledge.

- Multi-language document handling: Real Indian business documents mix English technical terms, Hindi descriptions, and regional language annotations within single invoices. This isn’t optical character recognition in multiple languages. It’s contextual understanding across language boundaries.

- Format diversity: Indian vendors use thousands of invoice format variations. From large enterprise standardized layouts to small vendor handwritten bills. Generic solutions optimize for format consistency. Indian document processing requires format adaptability.

DocXtract is purpose-built for this complexity. Not adapted. Built from first principles for Indian business document intelligence.

The architecture decisions reflect this India-first design:

We trained models specifically on Indian business documents. GST invoice structures, HSN code patterns, Indian vendor format variations. The AI understands Indian document conventions the way experienced Indian accountants do.

Compliance validation is built-in, not bolted on. GST number format verification, tax calculation rules, HSN code validation happens automatically as part of extraction.

The RESTful API delivers structured JSON output that matches Indian ERP expectations. CGST, SGST, IGST as separate fields. HSN codes linked to line items. Tax summaries pre-calculated.

RPATech’s India-first approach:

We’re not a global vendor localizing for India. We’re an Indian automation company building for Indian business reality. This design philosophy shows up in extraction accuracy, compliance confidence, and implementation speed.

When international solutions require 6 months of customization to handle Indian invoices, DocXtract delivers production-ready accuracy in 7 days. The difference is architectural, not configurational.

Straight-Through Processing: The Real Automation Standard

The automation industry has normalized “human-in-the-loop” workflows. Systems extract data, humans verify accuracy, corrections get logged, next batch requires the same intervention.

This isn’t automation. It’s assisted manual processing.

True invoice processing automation achieves straight-through processing. Document input, intelligent extraction, automatic validation, ERP integration. Zero human intervention for standard invoices.

The requirements for straight-through processing are precise:

- 98%+ extraction accuracy: Below this threshold, error rates require human verification that defeats automation value. Above this threshold, exception handling becomes manageable at scale.

- Built-in validation logic: Extraction alone isn’t sufficient. The system must validate that extracted data makes business sense. Tax calculations are correct. Totals reconcile. Codes are valid.

- Seamless integration: APIs must deliver data in formats that downstream systems consume without transformation. Friction in data handoffs creates processing bottlenecks.

- Intelligent exception routing: The 2% of cases requiring human review must route automatically to appropriate expertise. Not all exceptions are equal.

DocXtract achieves straight-through processing for 95%+ of invoices. The remaining 5% represent genuine edge cases: damaged documents, completely non-standard formats, missing critical information.

This performance level transforms finance operations:

- Payment cycles compress: Invoice receipt to payment approval happens in hours, not days. Early payment discounts become standard, not exceptional.

- Team focus shifts: Finance operations move from transaction processing to spend analysis, vendor management, and strategic procurement support.

- Compliance becomes automatic: Audit trails are comprehensive. Every extraction includes confidence scores. Exception reports identify potential compliance issues proactively.

- Scalability becomes linear: Processing 100 invoices requires the same effort as processing 10,000. Volume growth doesn’t demand proportional headcount growth.

The RPATech standard

We measure success by straight-through processing rates, not extraction accuracy alone. Accuracy is necessary but not sufficient. The real metric is how many invoices flow from receipt to ERP without human intervention.

This is the automation standard that delivers actual business value.

What This Means for Your Finance Operations

Invoice processing automation with AI-powered document processing isn’t incremental improvement over manual processes. It’s a complete reimagining of how finance operations work.

The transformation happens across multiple dimensions:

- From cost center to value generator: Finance operations traditionally focus on cost control and compliance. Intelligent automation frees capacity for strategic analysis. Spend pattern recognition, vendor performance analytics, cash flow optimization. The team shifts from processing to insight generation.

- From batch processing to real-time intelligence: Traditional invoice processing happens in cycles. Weekly batches, monthly closes, quarterly reviews. AI-powered document processing enables continuous processing. Real-time visibility into payment obligations, spend patterns, and vendor performance.

- From error correction to exception management: Manual processes generate errors requiring correction. 98%+ accurate automation generates exceptions requiring judgment. Your team stops being data validators and becomes decision makers on genuinely complex cases.

- From compliance anxiety to compliance confidence: GST audits transform from documentation nightmares to data queries. Every invoice has complete audit trails. Every extraction is validated. Every exception is logged. Compliance shifts from retroactive verification to proactive assurance.

The implementation timeline matters as much as the technology capability. Traditional OCR projects require 6-month custom development cycles. Template configuration, vendor format mapping, integration testing, user training. By deployment, business requirements have changed.

DocXtract delivers production-ready invoice processing automation in 7 days. RESTful API integration, structured JSON output, built-in GST validation. No templates to configure. No formats to map. No custom development required.

This speed-to-value changes the automation conversation. Instead of multi-quarter IT projects requiring executive sponsorship, you get operational improvements that finance teams can implement directly.

The Future of Document Intelligence

Invoice processing is the entry point. The intelligence framework extends to every business document type.

DocXtract currently delivers 98%+ accuracy on Indian invoices with production deployments across finance operations. Purchase Orders and Goods Receipt Notes are launching next, extending the same contextual understanding to procurement workflows.

But the vision is broader. Every business process stops at document processing. Contracts waiting for review. Customer onboarding stuck on KYC verification. Procurement decisions delayed while vendor documents get analyzed.

Information flows at the speed of the slowest document in the chain.

AI-powered document processing eliminates this bottleneck. Not just for invoices. For every document type that drives business processes.

The technology foundation we’ve built, multi-modal AI, contextual understanding, business logic validation, scales across document types. The architecture that achieves 98%+ invoice accuracy applies to contract analysis, KYC automation, procurement intelligence, compliance documentation.

RPATech’s document intelligence roadmap

We’re building the intelligent document processing infrastructure that Indian businesses need. Starting with the highest-volume use case (invoices) and expanding to comprehensive document intelligence across finance, procurement, legal, and compliance operations.

The goal isn’t better OCR. It’s business process acceleration through document intelligence that understands context, validates logic, and delivers audit-ready structured data.

At RPATech, we’re already enabling this transformation for finance teams processing thousands of invoices monthly. The technology is production-ready. The business value is proven. The expansion to comprehensive document intelligence is underway.

Your invoice processing just got so much better. And this is just the beginning.

Ready to Transform Your Invoice Processing?

DocXtract delivers 98%+ field accuracy on Indian invoices with 7-day implementation timelines. Start with 100 free API calls monthly and scale based on your processing volume.